The startup ecosystem in India has become enormous, and the government is also supporting startups. The Startup India scheme was started a few years ago, in 2016. To explain, it offers many types of incentives to business owners who want to launch a startup. Businesses in their early stage have access to funds under the scheme.

You can learn about the startup India registration process in this blog. It is simple and easy to follow. Please read the information we have provided carefully and register your startup.

Importance Of Startup India Registration

Registering a startup under the Startup India scheme can have many benefits. Business owners should consider how startup India registration can benefit their business.

- Firstly, you can get government tenders if you have recognized your business by DPIIT. Concerning this, you don’t need to have prior experience and show proof under the Startup India scheme. Additionally, a business has no condition to have a minimum annual turnover to be eligible for government tenders.

- Secondly, you get tax exemption if you register your business under the Startup India scheme. The 80-IAC clause exempts you from tax in the Income Tax Act. If the income tax department approves your business, you don’t need to pay taxes for 3 years. Moreover, the Income tax act allows you not to pay angel tax if you have a recognized startup, according to Section 56.

- The next step for Startup India registration is registering the business with Startup India. The Fund of Fund For Startups (FFS) operated by SIDBI gets you investment from its ten thousand crore rupees fund. Also, you get funding from the seed round of investment in the Startup India scheme.

- If they fail, business owners have an easy and hassle-free exit under the Startup India scheme. Likewise, startups that DPIIT recognizes can shut down within 3 months starting from when they apply to close their business.

- It is costly to get patents and trademarks for a business. Also, applying for a patent or trademark and getting it approved takes a long time. What is more, the charges of patent and trademark are relatively much less if you have a business that is DPIIT recognized. Startups get an eighty per cent discount on the fees of patents in the Startup India scheme. In addition, there is a fifty per cent discount on the fees of trademarks. Moreover, you get your patent or trademark quickly without delay or waiting. The authorities process your application within seventy-two hours.

Eligibility Criteria For Startup India Registration

The Startup India scheme has specific criteria for startups who can register themselves.

- Firstly, your business should be 1-10 years old and not more than this. This is counted from the date you have incorporated your company.

- Secondly, you need to incorporate your business as a Private Limited Company. If you have incorporated the business as a Registered Partnership Firm, you can still register under Startup India. In addition, businesses that are incorporated as Limited Liability Partnerships are eligible to register themselves.

- Next, your company’s turnover should be less than a hundred crore rupees per annum since you have incorporated the business.

- Your business should be original. At the same time, if you have made a company after dividing or rearranging an existing business, you are not eligible to register.

- Lastly, you can register if your company is scalable and you develop and process a product. In addition, your business should be oriented toward generating money and providing employment to people.

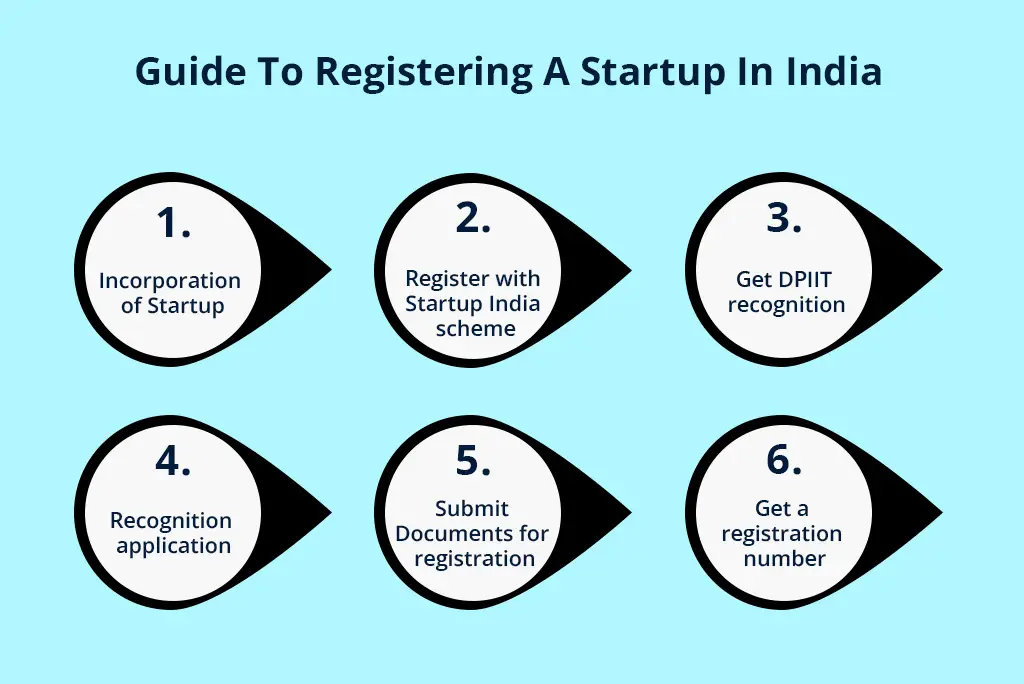

A Step-By-Step Guide To Startup India Registration

First, business owners who want to register their company under the Startup India program should incorporate their business as a Private Limited Company or Limited Liability Partnership. Additionally, they can do the registration as a partnership firm.

Second, you have to register the business under the Startup India scheme. You can do Startup India registration online. Please visit the official web portal of Startup India.

Afterwards, type your name, email address, contact number, and password. Once you do this, you need to click on the Register button. After that, enter the OTP that you will receive on the page. Provide details like user type, name and stage of your business, and other information. You will be registered once you click the Submit button, and your profile will be created. You can apply for support and mentorship programs on the Startup India web portal.

Next, you need to get DPIIT recognition. You get many benefits from the Department for Promotion of Industry and Internal Trade when you apply for recognition:

- First, you’ll log in to the web portal of Startup India. Use the registered account credentials for this.

- You will see a Recognition tab; under it, there will be an option to Apply for DPIIT Recognition. Please click on it.

- You must select the type of your startup you have incorporated.

If you choose the option of Apply for Company or LLP, you will be taken to the National Single Window System (NSWS) web portal. Lastly, you need to click on the form for Registration as a Startup. This will help you get DPIIT recognition.

The next step is entering details on the Startup Recognition Form. With this in mind, you’ll need to fill out information like business details, official address, information about your company’s authorized representative, and information about directors and partners. Furthermore, you need to provide information about your startup activities. Also, it would be best if you did a self-certification.

Lastly, people registering their Startup under the Startup India scheme must submit some documents. It includes the PAN number, incorporation certificate, authorization letter of the representative, pitch deck proof, funding proof, patent and trademark information, and awards details.

Users will get a registration number after the verification of their documents.

Tips And Best Practices For Successful Startup India Registration

Just thinking about applying for the Startup India registration is not enough. Any business owner who wants to register their Startup must conduct thorough research and understand the eligibility criteria. Concerning this, I would like to point out that getting to know the terms and conditions of the scheme should be your priority. Additionally, you must understand what the scheme offers you and what you must do for startup India registration.

The next step should be gathering and organizing the necessary documentation. Ensure that you have all the required documents with you. Also, fill in the correct information asked in the forms and recheck before you submit them finally.

Seek professional assistance if required. If you find out anything you need help understanding about the Startup scheme, take the help of an expert or professional. Get your doubts and queries solved to avoid confusion.

Lastly, follow the registration process diligently. Do all things that are needed to register your business. With this in mind, avoid missing out on any step, thinking it is unimportant. You can register under the Startup India program if you follow the steps correctly.

FAQ’s

Q. What legal structure should I choose for my startup?

A. First, the most suitable legal structure for a startup Under the Startup India scheme is a Private Limited company or LLP. Investors prefer to put their money into a Private Limited company—additionally, investors also like LLP.

Q. How do I register my startup’s name?

A. First, you can choose a unique name for your Startup that is not used by any other business. After that, register the name you have selected on the official website of Startup India. Next, you need to get DPIIT recognition for your business.

Q. What licenses and permits do I need?

A. Startups need shop and establishment licenses, import export code registration, company or LLP registration, GST registration, FSSAI license, import export code, and other licenses and permits.

Q. How do I protect my intellectual property (IP)?

A. Business owners can apply for copyrights, trademarks, and patents under the Startup India scheme and get approval.

Q. What are the tax obligations for my startup?

A. You must pay direct and indirect taxes under the Startup India scheme. However, you also get some tax exemptions.

Conclusion

In conclusion, Startup India is the best Government of India scheme for startups. We have discussed details like the scheme’s benefits and the Startup India registration process. Aspiring startups and new entrepreneurs may register their businesses and take advantage of the incentives offered by the program. We hope that you found the blog helpful and informative. Register your business under Startup India Scheme and take it to great heights.