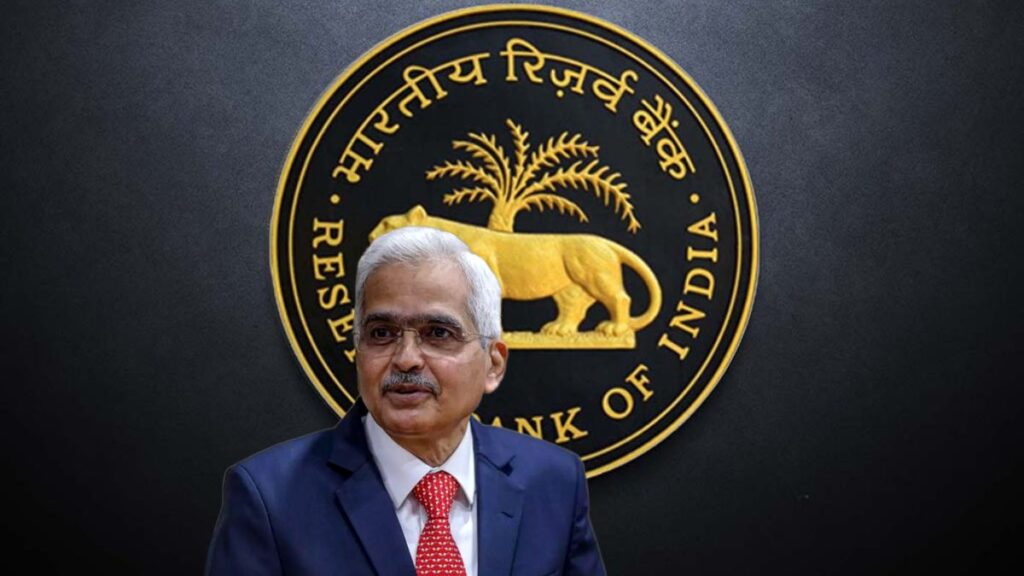

Reserve Bank of India (RBI) Governor Shaktikanta Das recently announced the first monetary policy for the financial year 2024-25. They kept the key policy repo rate unchanged at 6.5% for the seventh time in a row. The RBI’s Monetary Policy Committee (MPC) made this decision after a two-day review meeting that started on April 3 and ended on April 5.

The MPC, chaired by Governor Das, also maintained the policy stance at ‘withdrawal of accommodation’. The RBI predicts India’s real GDP growth rate for FY25 to be 7%, with CPI inflation estimated at 4.5%. Last year, in April, the rate increase cycle was paused after six consecutive hikes totaling 250 basis points since May 2022. Governor Das mentioned that the MPC voted 5:1 in favor of keeping the repo rate unchanged at 6.5%. Stay updated with live updates on the RBI MPC Meeting 2024 here.

Key Highlights from RBI Governor Shaktikanta Das’ Speech

- Inflation Target: The RBI remains committed to aligning inflation with the target of 4%.

- Global Economic Concerns: High global debt-to-GDP ratio could affect emerging economies like India.

- Monetary Policy Stance: The MPC focuses on withdrawing an accommodative stance.

- Economic Growth: Rural demand is increasing, which is expected to support economic growth in FY25.

- Private Investment: The manufacturing and services sectors’ momentum could boost private investment.

- GDP Growth Projection: India’s GDP growth for FY25 is projected at 7%.

- Crude Oil Prices: The recent uptick in crude oil prices needs close monitoring due to its impact.

- Geopolitical Risks: Continuing geopolitical tensions could raise commodity prices.

- Currency and Remittances: The Indian rupee remains stable among emerging markets, with India being the largest recipient of remittances.

- Inflation Management: High food inflation could disrupt inflation expectations.

- Forex Reserves: Efforts are made to build strong forex reserves, reaching an all-time high of $645.6 billion.

- Governance in Financial Institutions: Emphasis on maintaining high governance standards in banks, NBFCs, and financial institutions.

- Monetary Policy Transmission: This continues to be a work in progress in the credit market.

- Green Bonds and UPI: Plans to introduce trading on sovereign green bonds and allow cash deposits through UPI.

- Cash Deposits and Interest Rate Futures: Proposal to permit cash deposits via UPI and small finance banks to use interest rate futures for hedging.

- Future Plans: The upcoming decade will be transformational as RBI moves towards its centenary.

- CBDC and Payment Systems: Third-party apps may soon offer PPI for UPI, and CBDC distribution could be allowed via non-bank payment system operators.

RBI Retains Inflation Projection at 4.5% for Current Fiscal Year

The Reserve Bank of India (RBI) decided to keep its inflation projection unchanged at 4.5% for the current financial year, which is lower than last year’s 5.4%. This projection is based on the assumption of a normal monsoon. The CPI (consumer price index-based) inflation for the year is expected to be 4.5%, with specific projections for each quarter: 4.9% for Q1, 3.8% for Q2, 4.6% for Q3, and 4.5% for Q4.

RBI Governor Shaktikanta Das emphasized the importance of monitoring food prices, especially with the forecast of higher temperatures from April to June. He also mentioned that the impact of reduced fuel prices on inflation will become more significant in the upcoming months.

Additionally, at a post-policy press conference, RBI Deputy Governor M. D. Patra clarified that there are no changes in RBI’s policies regarding foreign exchange risk management, particularly concerning exchange-traded currency derivatives.

Also Read: New Tax Laws from April 1: All You Need to Know on Basic Exemption Limit and Rebates

RBI Eliminates Hidden Charges by Banks and NBFCs With New Rules on KFS