RBI and the Monetary Policy Committee have taken several steps in 2023 to fight the problem of inflation.

The beginning of 2023 saw an inflation rate of about 6.5%. To tame it, RBI took the initiative to change its policies in the current year. Apart from this, it also adjusted the interest rate multiple times. These steps aim to promote economic growth and stability.

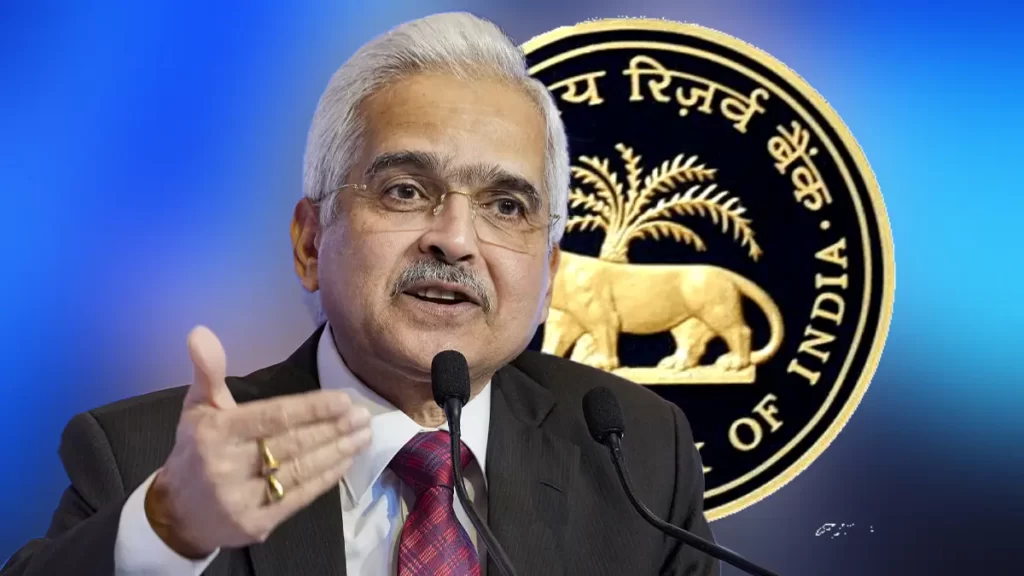

Shaktikanta Das, the RBI governor said they would be maintaining Arjuna’s eyes on the rise of inflation. He has referred to Arjuna’s analogy several times to emphasise that RBI wants to lower the rate of inflation to a level of 4%, with its upper and lower tolerance bands being fixed at 6 per cent and 2 per cent, respectively. This year, inflation has troubled consumers a lot. It has been a topic of interest for policymakers. Arjuna’s eye emphasises RBI’s focus on reducing inflation levels just as Arjuna focused on his aim while shooting an arrow.

Das further said that we will have to see ahead in future beyond the Arjuns’s eyes and implement the different inflation-controlling policy instruments.

RBI’s Policies to Tame Inflation

The policy changes that RBI made in 2023 were made to improve the monetary condition of the country and deal with the basic reason why inflation increased in the first place. Here, RBI adopted a holistic approach to control inflation. Liquidity recalibration is among the major decisions of the leading bank of India this year. It helped the banks control liquidity in a better way.

Interest Rate Changes

The Monetary Policy Committee implemented pre-planned rate cuts all year round. This was done to encourage economic activity and growth.

The RBI increased the repo rate to 6.5% at its meeting that was held in February 2023. The committee watched the scenario of inflation with strict vigilance and made policy changes to combat it.

It maintained the policy repo rate at 6.5% without any changes on 6th December this year. The decision to raise the repo rate to 6.5% helped in maintaining tight liquidity. The short-term rates were maintained at 6.85-6.9%. In terms of basis points, this is equal to 35-40 basis points. This amount is more as compared to the repo rate.

One basis point is the same as 1/100 of a percentage point.

Experts are still analysing how the RBI’s policies and changes have impacted the current state of inflation. Its effect will be more clear with time. The system is still processing the impact of higher rates.

Challenges Ahead

The factors that create a problem in making inflation-related policies for the Central Bank are global prices, disruption and war, and disturbances in the supply chains. RBI will have to make strategies according to the prevailing world conditions.

Source: https://economictimes.indiatimes.com/

Read More: Tax Crackdown: I-T Scrutinizes Employers & Employees for Mismatched TDS Claims

Centre to Provide ₹72,961 Crore Boost to States in Additional Tax Devolution

Parliament Approves Rs 58,378 Crore Surplus Spending for MGNREGA, Fertiliser Subsidies and Others