The Reserve Bank of India (RBI) has decided to maintain the benchmark repo rate at 6.5 per cent keeping key interest rates unchanged for the second consecutive time as inflation moderates. Without any opposition, the Monetary Policy Committee (MPC) made this decision during its bi-monthly monetary policy meeting.

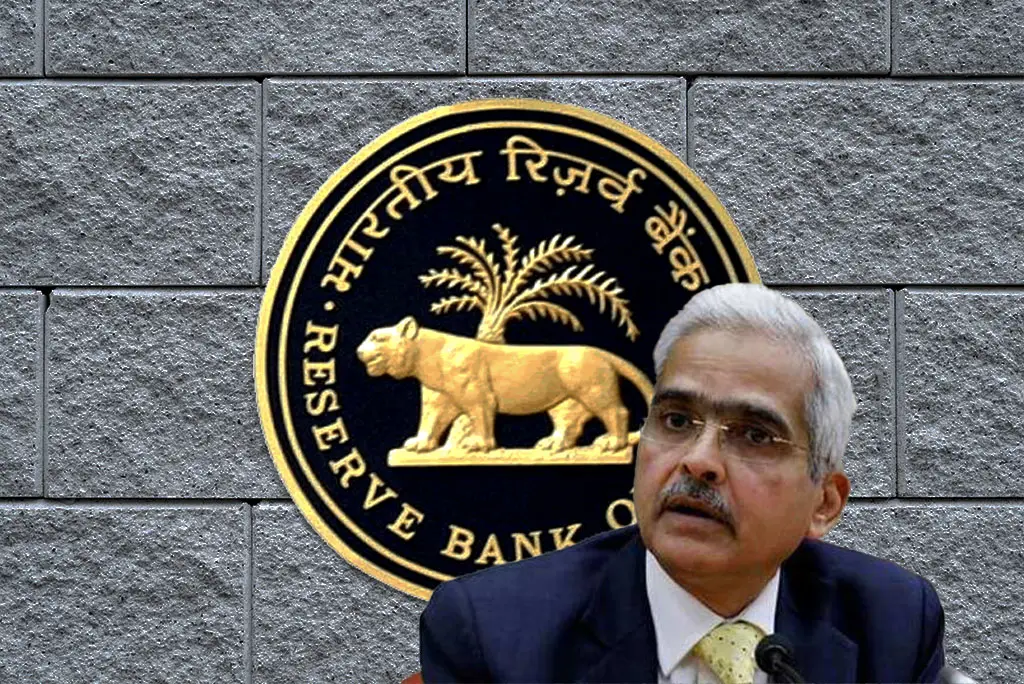

RBI Governor Shaktikanta Das announced the status quo on interest rates. He stated that the central bank is using the current favourable balance of growth and inflation dynamics as an opportunity to maintain stability. Given the manageable external sector and overall economic calm, the RBI aims to buy time and delay any further rate hikes.

He also mentioned that the RBI MPC decided to maintain the status quo as the money supply surged 10.1 per cent year-on-year while non-food bank credit grew by 15.6 per cent. He emphasized the average daily LAF absorption increase to 1.7 lakh crore in April-May from 1.4 lakh crore in February-March. As of June 2, 2023, India’s foreign exchange reserves stood at $595.1 billion.

Response to RBI Policy

Despite expectations of a policy rate reduction in the next review meeting, Atul Banshal, Director-Finance at Omaxe, believes that the RBI will continue with the extended pause on interest rates. He suggests that a rate cut would boost various sectors, including real estate, and foster economic growth.

Rajeev Radhakrishnan, CFA, Chief Investment Officer – Fixed Income at SBI Mutual Fund, is concerned about the global monetary policymaking pause-restart cycle. He supports the RBI’s focus on liquidity withdrawal. He also emphasized the importance of maintaining the midpoint inflation target of 4 per cent rather than merely relying on the current CPI figures.

Naveen Kulkarni, Chief Investment Officer at Axis Securities PMS, believes the RBI would keep interest rates on hold for future use. While inflation is expected to remain over the tolerance level in FY24, the RBI has cut its inflation projection somewhat.

Amit Jain, CMD of Arkade Group, views the RBI’s decision to keep the rate unchanged as positive for the real estate sector and home buyers. He believes that this move will not impact EMIs and, therefore, expects the momentum in home sales to continue.

Anand Rathi’s expert suggests that the RBI’s cautious approach, considering upside risks such as the potential impact of El Nino and monetary tightening by major central banks, is justified. He anticipates that the monetary policy announcement will not significantly affect the financial markets.

Anu Aggarwal, President and Head of Corporate Banking at Kotak Mahindra Bank, expected the policy rates to remain unchanged, considering the cooling inflation, driven partly by the base effect and lower oil prices. She believes that interest rate stability will support local demand and growth, boosting capital expenditure plans.

An official from Kotak Mahindra Bank suggests that maintaining interest rate stability will have a greater multiplier effect on investment spending than consumption spending. This stability will encourage businesses and support local demand and economic growth.

Impact of Rs 2,000 Notes Withdrawal

The withdrawal of Rs 2,000 notes has had a significant impact on the liquidity in the banking system. It contributes to the surplus liquidity observed by the RBI. This has played a role in the central bank’s decision to maintain the status quo on interest rates. The circulation of these notes has increased the money supply and liquidity in the economy. Thus, the RBI must carefully assess the situation and monitor its effects on inflation and overall economic stability.

Sujan Hajra, Chief Economist and Executive Director at Anand Rathi, credits the withdrawal of Rs 2,000 notes for the surplus liquidity in the banking system, leading to the status quo decision by the RBI. However, he also points out that RBI projections indicate the inflation target of 4 per cent will be exceeded throughout the current fiscal year.

Sandeep Bagla, CEO of Trust Mutual Funds, highlights the need to reduce liquidity surplus resulting from circling Rs 2,000 notes in the banking system. He cautions that market yields might rise as the RBI waits for more economic cues amidst contradictory global signals on inflation and growth.