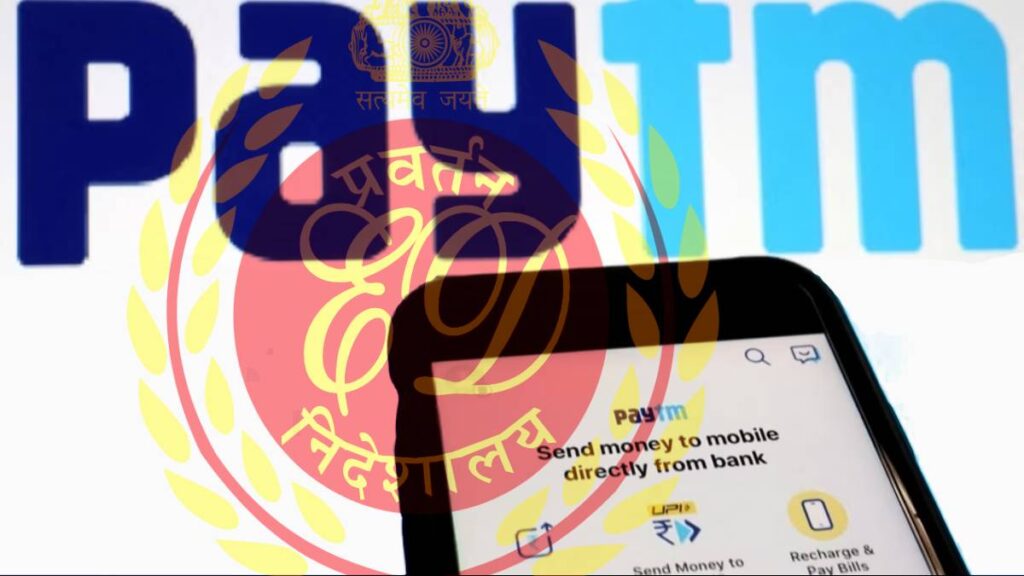

India’s financial crime-fighting agency requests details on overseas transactions from Paytm Payments Bank, a unit of One 97 Communications, one of the country’s largest payment operators.

Earlier this month, Reuters reported that the Enforcement Directorate had initiated a probe into One 97 Communications, also recognized as Paytm, suspecting a violation of foreign exchange rules. The firm had denied allegations of forex violations.

Two weeks after the country’s central bank ordered Paytm Payments Bank, an affiliate of Paytm, to shut most of its business, including deposits, credit products, and its popular digital wallets, by the end of February, citing “persistent non-compliance,”

Paytm told CNBC-TV18, “We have always complied with the requirements dutifully.”

Enforcement Directorate Initiates Preliminary Investigation into Paytm Payments Bank

Paytm and the Enforcement Directorate did not immediately respond to Reuters’ requests for comment.

As per one of the government sources, this is a preliminary examination.

Reports indicate that the Enforcement Directorate has launched a preliminary investigation into overseas transactions of its banking arm, Paytm Payments Bank Ltd (PPBL), marking another setback for Paytm founder Vijay Shekhar Sharma. This move follows an earlier Reuters report claiming that the ED had initiated a probe on suspicion of violations of FEMA (Foreign Exchange Management Act) rules.

Earlier, the company dismissed reports of an ED probe, stating,

“We have consistently assured that neither Paytm nor any of its associates are under investigation by any regulatory agency. This stance has been further validated by recent statements from senior government officials. Our commitment remains unwavering towards operating in compliance with regulatory guidance and continuously enhancing our processes to further the reach of digital payments across India.”

The investigating agency had first sought more information from the Reserve Bank of India, which ordered the Paytm Payments Bank to wind down much of its business by Feb. 29, citing persistent and serious supervisory concerns.

RBI Stands Firm on PPBL Decision

On Monday, the Reserve Bank of India (RBI) clarified that no plans are underway to reassess actions taken against PPBL. The regulator underscored that its decision regarding the fintech giant stemmed from thoroughly evaluating the company’s operations.

Reports from PTI revealed that RBI Governor Shaktikanta Das reiterated there would be no reconsideration of the disciplinary measures imposed on PPBL. Speaking at a press briefing following the 606th meeting of the Central Board of Directors of the RBI, Das emphasized,

“I want to emphasize that there is currently no intention to revisit the decision regarding PPBL. If there are any expectations for a review, let me make it abundantly clear that there will be no such reconsideration.”

In the wake of RBI curbs on the fintech major, Paytm has lost nearly 55 per cent of its market value. The company’s shares fell nearly 10 per cent on Wednesday. This development occurred after global brokerage firm Macquarie downgraded One97 Communications’ rating to ‘Underperform’, cutting its target price from Rs 650 to Rs 275 per share amid significant revenue loss across segments.

Also Read: Visa and Mastercard Halt Business Payments Via Cards Following RBI Order

PM Surya Ghar: Muft Bijli Yojana to Usher in Solar Revolution in India

Electric Air Copters by Maruti Suzuki to Revolutionize Mobility